simplefastloans.com Reviews

is simplefastloans.com legitimate or a scam?Why is the trust score of simplefastloans.com very low?

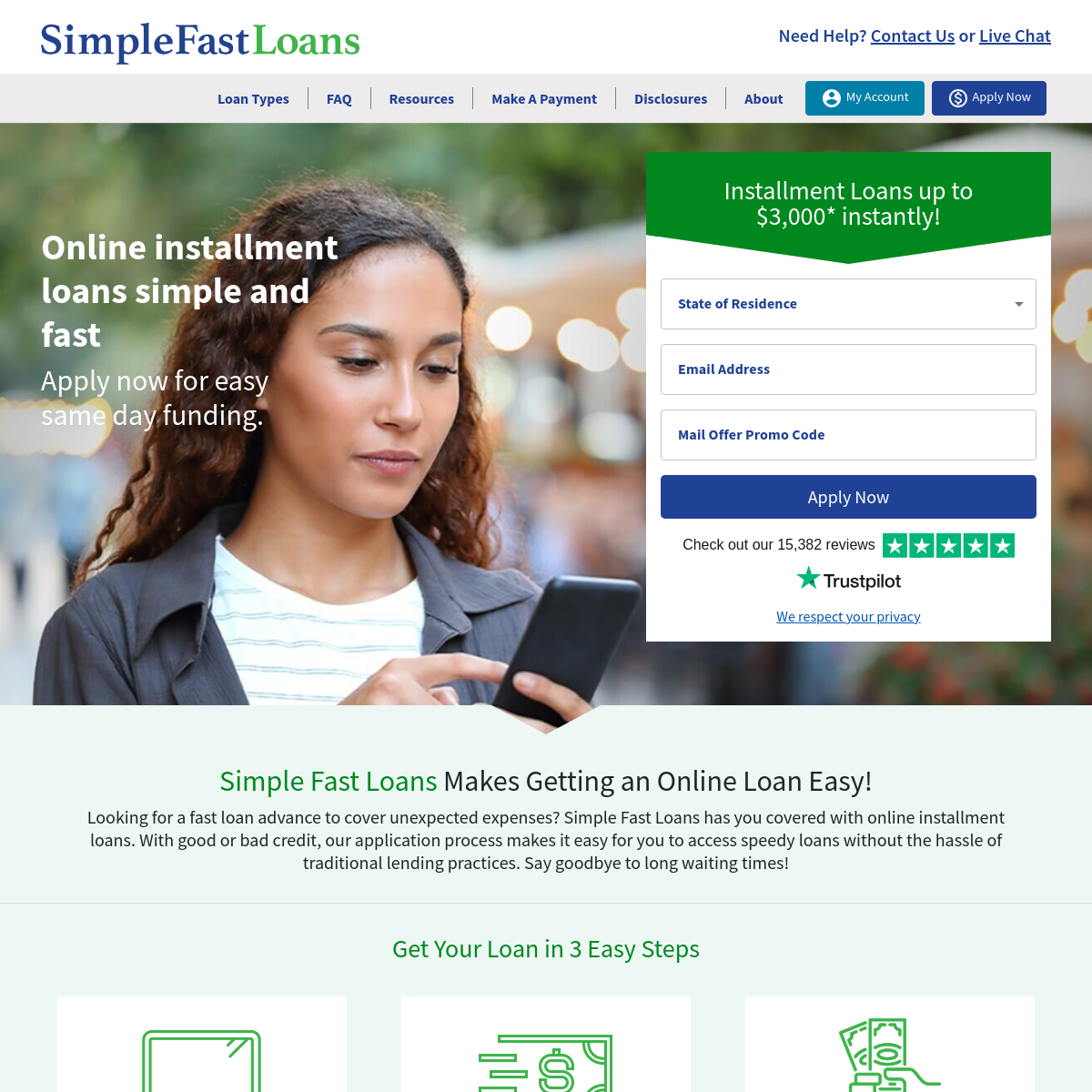

The website simplefastloans.com offers online loans with same-day approval and next-day funding. It claims to provide quick cash advances and easy personal installment loans online, with loan amounts ranging from $200 to $3,000. The site emphasizes a simple and fast application process, with the ability to get funds deposited into the borrower’s account by the next business day. It also mentions that the loans are available to individuals with both good and bad credit.

However, there are several red flags and potential concerns that should be carefully considered:

1. High Interest Rates: Many online lenders that offer quick and easy loans, especially to individuals with poor credit, often charge extremely high interest rates. These rates can sometimes exceed 100% APR, making the loans very expensive and potentially trapping borrowers in a cycle of debt.

2. Lack of Transparency: The website does not provide clear information about interest rates, fees, or the total cost of borrowing. Transparency is crucial in the lending industry, and the absence of this information is a significant concern.

3. Limited Regulation: Some online lenders operate in states or jurisdictions with lax regulations, allowing them to charge exorbitant interest rates and fees. Borrowers should be cautious when dealing with lenders in less regulated environments.

4. Aggressive Marketing: The website’s emphasis on quick and easy loans, regardless of credit history, can be a common tactic used by predatory lenders to attract vulnerable borrowers.

5. Customer Reviews and Reputation: It’s important to research the lender’s reputation and look for customer reviews and complaints. If there are numerous negative reviews or reports of unethical practices, it’s a major warning sign.

6. Alternative Options: Before considering high-cost loans from online lenders, borrowers should explore alternative options, such as credit unions, local banks, or nonprofit organizations that offer fair and affordable lending.

7. Financial Counseling: Individuals facing financial difficulties should seek advice from reputable financial counselors or advisors. They can provide guidance on managing debt and finding the best solutions for their specific situations.

In summary, while the website simplefastloans.com may offer quick and convenient access to funds, especially for individuals with poor credit, it’s crucial for borrowers to exercise extreme caution. High-interest rates, lack of transparency, and aggressive marketing tactics are common red flags associated with predatory lending. Before considering a loan from this or any similar lender, individuals should thoroughly research the company, understand the terms and costs of borrowing, and explore alternative, more affordable options.”

the reasons behind this review :

High Interest Rates, Lack of Transparency, Limited Regulation, Aggressive Marketing, Customer Reviews and Reputation, Alternative Options, Financial Counseling

| Positive Points | Negative Points |

|---|---|

Website content is accessible No spelling or grammatical errors in site content Domain Age is quite old Archive Age is quite old Domain ranks within the top 1M on the Tranco list | Low review rate by AI High gap ratio (1.27) for older domain Whois data is hidden |

How much trust do people have in simplefastloans.com?

Domain age :

19 years and 10 months and 29 days

WHOIS Data Status :

Hidden

Website :

simplefastloans.com

Title :

Simple Fast Loans: Online Loans in Minutes

Description :

Get online loans with same-day approval and next day funding. Simple Fast Loans offers quick cash advance and easy personal installment loans online.

Website Rank :

599012

Age of Archive :

11 year(s) 7 month(s) 2 day(s)

SSL certificate valid :

Valid

SSL Status :

Low - Domain Validated Certificates (DV SSL)

SSL issuer :

Amazon

WHOIS registration date :

2005/02/16

WHOIS last update date :

2025/01/07

WHOIS Renewal Date :

2025/02/16

Organization :

Domains By Proxy, LLC

State/Province :

Arizona

Country :

US

Phone :

+1.4806242599

Email :

Select Contact Domain Holder link at https://www.godaddy.com/whois/results.aspx?domain=simplefastloans.com

IP : 99.84.160.8

ISP : AS16509 Amazon.com, Inc.

Country : US

IP : 99.84.160.21

ISP : AS16509 Amazon.com, Inc.

Country : US

IP : 99.84.160.86

ISP : AS16509 Amazon.com, Inc.

Country : US

IP : 99.84.160.60

ISP : AS16509 Amazon.com, Inc.

Country : US

Name :

GoDaddy.com, LLC

IANA ID :

146

Registrar Website :

https://www.godaddy.com

Phone :

+1.4806242505

Email :

abuse@godaddy.com

Target : ns-1860.awsdns-40.co.uk

IP : 205.251.199.68

ISP : AS16509 Amazon.com, Inc.

Country : US

Target : ns-405.awsdns-50.com

IP : 205.251.193.149

ISP : AS16509 Amazon.com, Inc.

Country : US

Target : ns-750.awsdns-29.net

IP : 205.251.194.238

ISP : AS16509 Amazon.com, Inc.

Country : US

Target : ns-1258.awsdns-29.org

IP : 205.251.196.234

ISP : AS16509 Amazon.com, Inc.

Country : US

This website was last scanned on January 7, 2025

tronnew.icu

The website tronnew.icu appears to be a scam. Here are several reasons: 1. Lack of Credible Information: The website provides very little information about its operations, team, or physical address....

music-saz.ir

The website 'music-saz.ir' appears to be a music download site, offering a wide range of music, including Iranian and international songs. It seems to focus on providing a variety of...

nirai.ne.jp

The website https://nirai.ne.jp is the official site for OCN (Okinawa Cable Network), a major telecommunications and internet service provider in Okinawa, Japan. The site offers information about various services provided...