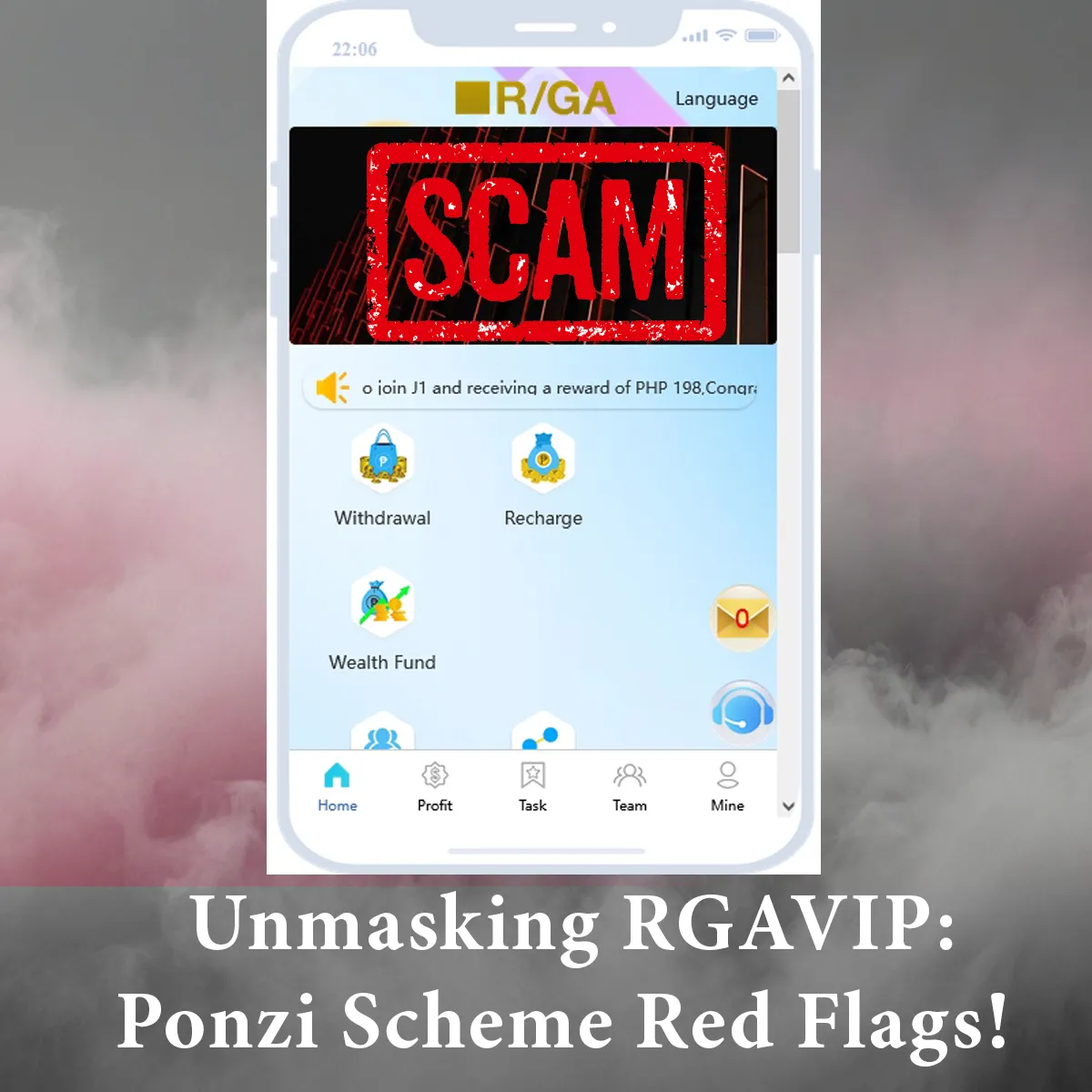

Unmasking RGAVIP: Ponzi Scheme Red Flags You Should Know

What is RGAVIP.com?

RGAVIP.com is an online platform that claims to offer charming investment opportunities with the promise of high, quick returns. They encourages individuals to deposit funds with the prospect of earning risk free profits in a short period of time. Additionally, RGAVIP.com offers referral bonuses, asking users to recruit others with the allure of earning even more money.

At first glance, the platform’s business model appears good and enticing. However, upon closer inspection, several concerning red flags shows up, raising suspicions about the legitimacy of RGAVIP.com’s operations.

Lack of Transparency: A Red Flag

One of the main RGAVIP.com red flags is lack of transparency about the company’s operations and management and its team. There is no “About Us” on the website, no listed contact information, and a total absence on social media platforms.

Legitimate businesses understand the importance of transparency and go to great lengths to establish trust with their customers and stakeholders. They proudly showcase their team, provide information about their operations and business model, and maintain an active online presence to engage with their audience. The fact that RGAVIP.com has none of these basic elements raises significant suspicion.

Ponzi scheme operators, on the other hand, rely on anonymity to continue their deception. Once the scheme runs its course, they disappear without a trace, leaving investors unable to recovering their losses.

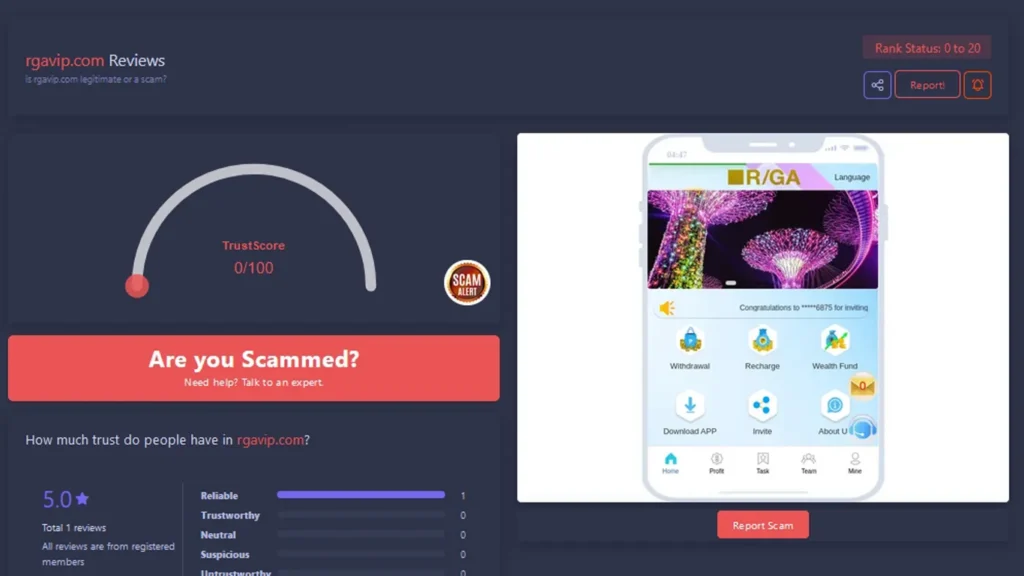

ScamMinder AI gave RGAVIP.com a 0/100 trust score and tagged it as a “Scam.” It’s filled with red flags like no contact info and unrealistic promises.(Read More)

The Ponzi Scheme Structure

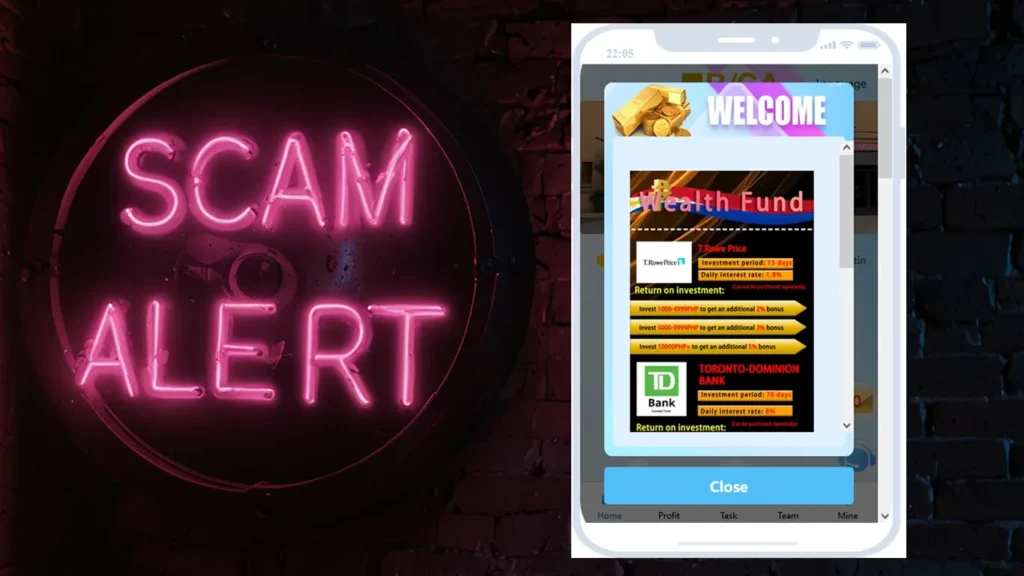

RGAVIP.com’s business model has many similarities to classic Ponzi schemes. New investors are enticed to deposit funds with the promise of high, quick returns. And the platform even offers lucrative referral bonuses for bringing in more participants. This setup is a telltale sign of a Ponzi scheme, where returns are not generated from legitimate profit-making activities. Instead, the funds from new investors are used to pay the earlier investors, creating an illusion of profitability.

This cycle of continuously recruiting new investors to pay off existing ones is unsustainable and ultimately doomed to collapse. Ponzi schemes are fraudulent, They rely on a constant inflow of new victims to sustain. Rather than generating actual profits from legitimate business operations.

No Legal Registration or Licenses

A legitimate investment platform is required to register with relevant financial authorities and obtain the necessary licenses to operate legally. These registrations and licenses serve as a form of oversight, ensuring that the platform adheres to regulations and operates transparently.

However, RGAVIP.com does not appear to register with any financial authority or possess any licenses. This lack of legal registration and licensing is a significant red flag, as it means the platform is operating outside of regulatory oversight and without any accountability.

Legitimate investment platforms proudly display their registrations and licenses as a sign of credibility and trustworthiness. The fact that RGAVIP does not provide any information about its legal status or compliance with regulations raises serious concerns about the legitimacy of its operations.

Without proper registration and licensing, there is no way to verify if RGAVIP is adhering to industry standards, implementing appropriate security measures, or operating within the bounds of the law. This lack of transparency and oversight increases the risk of fraud, mismanagement, or other unethical practices.

Linked to Other Suspected Scams

RGAVIP.com appears to be connected to several other websites that share similar red flags and associated with Ponzi schemes. These sites often pop up, promise high returns with minimal effort or risk, and then disappear without a trace. Only to resurface under different domain names and branding.

This pattern suggests that RGAVIP.com could be part of a larger network of scams, potentially operated by the same individuals or groups. By creating multiple websites with slight variations, these scammers can cast a wider net and lure in more unsuspecting victims.

The interconnected nature of these sites also makes it easier for the perpetrators to cover their tracks and evade legal consequences.

It’s crucial to be aware of these potential connections. And to exercise extreme caution when encountering websites with similar characteristics to RGAVIP.com. Thoroughly researching and verifying the legitimacy of any investment platform is essential to avoid falling victim to these sophisticated scam networks.

Patterns of Ponzi Schemes

Ponzi schemes often follow a predictable pattern that can help identify them before falling victim. One common tactic is the promise of unusually high returns in a short period. Which is luring in unsuspecting investors. These returns not made through legitimate business activities but rather by using funds from new investors to pay earlier ones, creating the illusion of profitability.(Investopedia)

Another telltale sign is the frequent disappearance and resurfacing of these schemes under different names or websites. Once a Ponzi scheme can no longer sustain itself by attracting enough new investors, the operators will often rebrand and relaunch their scam under a new guise, hoping to ensnare a fresh batch of victims.

Ponzi schemes also heavily rely on continuously targeting new investors to keep the scheme afloat. Promoters may use aggressive marketing tactics, such as offering referral bonuses or creating a sense of urgency and exclusivity, to entice more people to invest before the opportunity “runs out.”

By understanding these common patterns, investors should be aware to identify and avoid falling prey to Ponzi schemes. Which ultimately collapse, leaving most participants with significant financial losses.

Real Investment Platforms vs. Ponzi Schemes

Legitimate investment platforms and Ponzi schemes differ significantly in their operations, transparency, and business models. Reputable investment firms are legally registered and licensed, adhering to strict regulations and oversight from financial authorities. They provide detailed information about their management, investment strategies, and how they generate profits through legitimate business activities.

In contrast, Ponzi schemes operate illegally and thrive on secrecy. They lack transparency about their operations, often hiding the identities of the individuals running the scheme. Instead of generating profits through legitimate means, Ponzi schemes rely on a constant influx of new investors to pay returns to earlier investors, creating an unsustainable cycle.

Real investment platforms have sustainable business models based on sound investment principles and market dynamics. They generate returns through careful analysis, diversification, and strategic investment decisions. Ponzi schemes, on the other hand, rely solely on the continuous recruitment of new participants, eventually leading to their inevitable collapse when the flow of new funds dries up.

Legitimate platforms prioritize risk management, compliance, and investor protection. They are subject to rigorous audits and reporting requirements, ensuring transparency and accountability. Ponzi schemes operate in the shadows, avoiding legal scrutiny and offering little to no recourse for victims once the scheme unravels.

Avoiding Ponzi Scheme Traps

Ponzi schemes can be incredibly alluring, with their promises of high returns and low risk. However, it’s crucial to remain vigilant and exercise caution when considering any investment opportunity. Here are some tips to help you identify and avoid falling victim to these fraudulent schemes:

- Conduct Thorough Research: Before investing, thoroughly research the company, its management team, and their track record. Check for red flags such as a lack of transparency, limited information about their operations, or a lack of physical presence.

- Verify Licenses and Registrations: Legitimate investment firms and advisors must register with appropriate regulatory bodies and hold the necessary licenses. Check with your local financial authorities to verify the company’s credentials.

- Be Wary of Unrealistic Returns: If an investment opportunity promises guaranteed high returns with little to no risk, it’s likely too good to be true. Legitimate investments involve some level of risk, and returns are generally in line with market performance.

- Understand the Investment Strategy: Reputable investment firms should be able to clearly explain their investment strategies and how they generate returns. Be cautious of vague or overly complex explanations that obfuscate the underlying operations.

- Rely on Trusted Sources: Consult with licensed financial advisors, accountants, or lawyers before committing to any investment opportunity. They can provide objective advice and help you assess the legitimacy of the offer.

- Trust Your Instincts: If something feels off or too good to be true, it probably is. Don’t let the fear of missing out or the allure of quick riches cloud your judgment. If an offer seems suspicious, it’s better to walk away.

Remember, investing always carries some level of risk, and there are no shortcuts to building wealth. By exercising due diligence, relying on trusted sources, and being wary of unrealistic promises, you can protect yourself from falling victim to Ponzi schemes and other fraudulent investment scams.

Consequences of Participating in Ponzi Schemes

Participating in a Ponzi scheme, whether knowingly or unknowingly, can have severe legal and financial consequences. These fraudulent investment operations are illegal, and authorities take them very seriously.

From a legal standpoint, individuals who knowingly participate in a Ponzi scheme by actively promoting or recruiting new investors can face criminal charges such as fraud, money laundering, and conspiracy. Depending on the scale of the scheme and the amount of money involved. Perpetrators could face substantial fines and even prison sentences.

Even those who unknowingly invest in a Ponzi scheme without realizing its fraudulent nature can face legal repercussions. While they may not be charged criminally, they could be subject to civil lawsuits from court-appointed receivers seeking to recover funds for victims. This could result in the loss of their initial investment and any perceived “profits” they may have received.

Financially, the consequences of participating in a Ponzi scheme can be devastating. These schemes are unsustainable by nature, and when they inevitably collapse, most investors lose their entire principal investment. The longer a Ponzi scheme operates, the more victims it accumulates, and the greater the financial losses when it ultimately unravels.

Furthermore, any profits or returns received from a Ponzi scheme are considered ill-gotten gains and may be subject to clawback actions by court-appointed receivers. This means that even if an investor profited initially, they could be legally obligated to return those funds to be redistributed to victims.

Final Verdict: Is RGAVIP.com a Ponzi Scheme?

After carefully examining the available evidence and analyzing the various red flags surrounding RGAVIP.com. It is highly likely that this platform is operating as a Ponzi scheme. The lack of transparency regarding the identities of those running the website. The absence of any legal registration or licensing, and the suspicious business model that promises high returns without disclosing legitimate profit-generating activities are all telltale signs of a Ponzi setup.

Moreover, the fact that RGAVIP.com appears to be linked to other dubious websites further reinforces the suspicion that this is part of a broader scam network. Such patterns of constantly resurfacing under different names while offering unrealistic investment opportunities are characteristic of Ponzi schemes.

The striking similarities to well-known Ponzi scheme tactics make it extremely unlikely that RGAVIP.com is a legitimate investment platform. Based on the analysis presented, it would be advisable to steer clear of this website and avoid falling victim to what is almost certainly a fraudulent Ponzi scheme.

Always verify a website’s legitimacy before investing. For quick, reliable checks, use ScamMinder AI to assess a site’s safety and avoid scams. Stay informed and protect your funds!